The State of Automotive CX in 2025: What the Data Says

Automotive brands are grappling with a conversion crisis as we head into 2025. Marketing costs have skyrocketed – the average cost per lead (CPL) for the auto industry has climbed to around €283 (blended across channels). Yet despite this heavy investment in capturing leads, only a small minority of automakers have a defined strategy to convert and retain those customers. In fact, research by Capgemini found that only 18% of automotive companies have a current and comprehensive customer experience (CX) strategy in place. This means most brands are pouring money into lead generation without a clear plan for nurturing prospects or delivering the kind of experience that justifies such spend. It’s a recipe for inefficiency – high acquisition costs with low follow-through.

Why does this gap exist? Many automakers have traditionally focused on the product – the vehicle itself – rather than holistic customer experience. But in 2025, customer experience is proving to be as critical as the cars. Consumers now compare their automotive shopping and ownership experiences to their interactions with tech and retail giants. As McKinsey notes, the auto customer experience has “adapted more slowly” than other sectors, often feeling outdated and inferior to consumer-tech standards. In practical terms, many digital car showrooms still function like static brochures – offering plenty of specs and images, but little in the way of personalized, interactive engagement. This disconnect between hefty marketing spend and CX execution is at the heart of the current conversion crisis.

Personalized Experiences or Bust

If there’s one takeaway for 2025, it’s that personalization is no longer optional – it’s expected. A striking 84% of consumers now say that personalized experiences influence where they choose to buy. Car shoppers have been spoiled by the likes of Amazon and Netflix, and they increasingly demand the same tailored treatment from auto brands. They want to be recognized across channels and see content, offers, and options that align with their interests and needs.

Yet for many automakers, delivering personalization at scale remains a challenge. The typical manufacturer or dealer website offers a one-size-fits-all catalog of vehicles – essentially a digital pamphlet – when customers are craving a customized journey. Static online showrooms are a liability in this environment. Shoppers notice when a brand’s digital experience is generic. In one survey, 71% of consumers said they expect companies to deliver personalized interactions, and 76% report frustration when this doesn’t happen. The auto industry’s slow pace in CX innovation (due to complex dealer networks and legacy systems) has left a gap where customer expectations outpace reality. The result? Lost sales and eroding loyalty. As one McKinsey report put it, younger customers in particular see the traditional car-buying experience as inconvenient, and they’ll gladly opt for alternatives if brands don’t step up.

Leading OEMs are starting to invest in personalization engines and richer digital interfaces – from virtual configurators to AI-driven recommendation chatbots – to turn their “online brochures” into interactive, guided shopping experiences. These efforts are about more than flashiness; they directly impact the bottom line. Personalized online experiences drive higher conversion rates and can even command price premiums, according to Forbes. In short, personalization pays off, and in 2025 it’s become a key battleground for automotive CX.

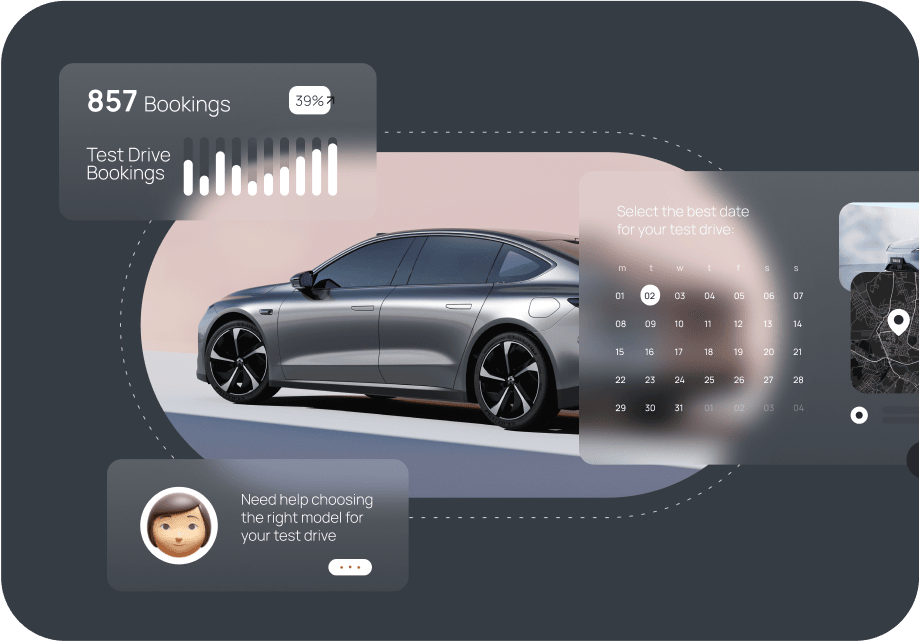

The Need for Speed: Instant Test Drives

Today’s car buyers not only expect personalized service, they expect immediacy. One of the clearest examples is how customers approach test drives. According to industry surveys, roughly 75% of car buyers prefer real-time scheduling options when booking a test drive online. In other words, the vast majority of shoppers want to schedule a test drive with a few clicks or taps – instantly, without waiting for a call-back. This makes sense in an on-demand era. If a dealership’s website or app doesn’t offer the ability to book a test drive on the spot, you risk losing an eager customer’s attention.

What happens when brands don’t meet this expectation? Nothing good. Long wait times and clunky scheduling processes actively frustrate potential buyers. In 2024, 55% of car shoppers said they had to wait for a test drive, up significantly from the year prior. Those delays aren’t just minor annoyances – they’re deal-breakers for many. Studies show that missed or drawn-out test drive appointments account for up to 30% of lost sales annually for dealerships. Shoppers will simply move on if it’s too much hassle to see the car they’re interested in. In an age of same-day delivery and instant answers, a slow manual booking system is enough to make a customer defect to a competitor who offers a smoother experience.

The message is clear: instant gratification wins sales. Automotive leaders are responding by implementing online test-drive schedulers and AI assistants to speed up the process. For example, Mercedes-Benz in the Middle East launched a bilingual Messenger chatbot that lets customers instantly book test drives and get vehicle recommendations via chat. Tesla has gone even further, rolling out a self-service test drive program across 160+ locations in Europe and the Middle East, where customers can book a test drive online in under a minute and receive an immediate confirmation. These initiatives eliminate friction from the test-drive stage – and they set a new benchmark that more mainstream brands will need to follow. The dealers who allow shoppers to “schedule now” (whether for a test drive, a service appointment, or a callback) are converting more leads at lower cost than those who force customers to wait.

Real-Time Engagement, Real ROI

Another data-backed lesson from 2025: engaging customers in real time isn’t just a nicety; it’s a conversion and cost game-changer. By real-time engagement, we mean things like live chat on your website, instant messaging follow-ups, interactive video consultations, and AI-powered agents that respond 24/7. These tools let brands catch the customer in the moment of interest – and the payoff is substantial. Companies that have implemented real-time engagement strategies have seen markedly improved marketing efficiency. In fact, some report that smarter real-time interactions can cut Customer Acquisition Cost (CAC) by up to 40% by converting existing traffic more effectively.

The logic is straightforward: When you engage a shopper at the peak of their interest – for example, answering questions via live chat while they’re configuring a car online – you’re far more likely to move them to the next step than if you let them bounce and try to re-engage later via email or phone. Quick responses also build trust. Consider that a well-known study found responding to a web lead within 5 minutes makes that lead 100x more likely to convert than waiting even an hour. Shaving down response time, whether through an actual human or an AI assistant, directly boosts conversion rates. Higher conversion of leads means a lower cost per acquisition.

We can see this effect across digital channels. For instance, dealerships using live chat and instant inquiry responses tend to capture more leads from the same ad spend, effectively lowering their CPL. Real-time engagement also often means multi-channel engagement – meeting customers on chat, text, social, or video depending on where they are. Brands that orchestrate these instant conversations across channels create a sense of attentiveness that customers reward. According to Bain & Co., engaged customers (who feel a company is responsive and in tune with them) spend 20% to 40% more on average. They also tend to stick around longer, improving lifetime value. All of this contributes to a better return on marketing investments.

Bottom line: speed and responsiveness have a quantifiable ROI in Automotive CX. By cutting down the lag between customer question and brand answer, automakers not only please the impatient modern consumer – they also trim the fat from their acquisition funnel. In 2025, more brands are catching on, deploying tools like AI chatbots on their sites, WhatsApp for Business messaging, and even live video shopping assistants. These real-time touches turn passive interest into active engagement, driving conversions while potentially reducing CAC by double-digit percentages for those who get it right.

Omnichannel Blind Spots and the Loyalty Cliff

It’s often said that selling a car is just the beginning of the customer relationship. The data in 2025 reinforces that truth – and highlights how poor post-purchase experiences can quickly erode brand loyalty. Many automakers have omnichannel blind spots when it comes to the ownership phase. Perhaps the dealership service department doesn’t communicate well, or digital and physical touchpoints aren’t linked, causing customers to repeat themselves. These lapses in after-sales and support have real consequences. Many CX researches indicate 57% of consumers who are unhappy with their vehicle’s post-purchase service plan to switch brands within 6–18 months. In other words, over half of dissatisfied owners will defect by the time they’re ready for their next car, often much sooner.

This is a staggering figure, and it underscores that loyalty in auto is fragile. Some of the biggest causes of dissatisfaction include lack of follow-up on issues, feeling “unknown” to the brand after the sale, and inconsistent experiences across touchpoints (e.g. the ease of the sales process vs. the frustration of the service process). For example, a customer might love the car and the purchase experience but then encounter unreturned calls or clunky online scheduling when trying to get warranty service – souring them on the brand. In Capgemini’s 2024 Automotive Consumer survey, only about 34% of customers felt their car brand delivers a top-tier CX overall. That means two-thirds see room for improvement, especially in areas like support and personalization after they’ve driven off the lot.

The cost of these omnichannel blind spots is not just one lost service visit – it’s the potential loss of a lifetime customer. Consider that retaining an owner for their next purchase (and maybe the one after that) is far more cost-effective than acquiring a new customer from scratch. Yet brands are losing over half of their unhappy customers within a year or two, largely due to fixable CX issues. To plug this leak, leading automakers are investing in unified customer data and journey management. They aim to ensure that whether a customer reaches out via the mobile app, a phone call, or a dealership visit, the experience is consistent, convenient, and context-aware.

For instance, some manufacturers now offer integrated ownership apps that handle everything from maintenance reminders to service scheduling and even community forums for owners. Companies like NIO have famously built loyalty through lifestyle-focused perks (NIO Houses as lounges, exclusive events) to keep owners engaged and valued. While not every brand will emulate that model, every brand must identify the pain points in their post-purchase journey and address them. Otherwise, the statistic above – 57% switching brands – will be an enduring black eye. In 2025, the competitive differentiator may well be how well an automaker cares for customers after the sale, as much as how it courts them before the sale.

How the Leaders Are Responding

The challenges in automotive CX are significant, but we’re seeing many forward-thinking brands respond with bold initiatives. The gap between customer expectations and the status quo has prompted innovative solutions from both automakers and dealers. Here are a few examples of how industry leaders are raising the bar:

-

Seamless Online-to-Offline Integration: Toyota has invested heavily in its SmartPath digital retail platform to unify the online and dealership experience. Launched in 2020, SmartPath allows customers to do everything from research vehicles, arrange financing, to scheduling pickup – all from home, with the data carrying into the showroom. As of 2025, over 1 million Toyotas have been purchased through SmartPathpressroom.toyota.com, demonstrating the demand for a seamless hybrid buying journey. Toyota’s success shows that customers will embrace online car buying at scale when it’s convenient and backed by a trusted brand.

-

Instant Engagement with AI Assistants: Leading OEMs are deploying AI-powered virtual agents to handle inquiries and guide customers. We mentioned Mercedes-Benz’s chatbot in the Middle East, which speaks multiple languages and can book test drives instantlylimelightplatform.com. Similarly, brands like Volkswagen and Hyundai are experimenting with AI chat on their websites and WhatsApp channels to answer shoppers’ questions in real time. By providing 24/7 instant responses about models, availability, and pricing, these brands keep potential buyers engaged and drop their perceived response time to near zero. Early results show higher lead-to-test-drive conversion rates when AI assistants are in the mix, because customers don’t slip away while waiting for answers.

-

Virtual Showrooms and Immersive Experiences: To address the “static brochure” problem, some automakers are turning to VR and interactive media. The Czech brand Škoda has gone a step further with what it calls the Škoda Live Tour: essentially, a permanent virtual showroom that supports both one-to-many broadcasts and one-to-one consultations. During scheduled live-stream events, hundreds of viewers can tune in to a product expert showcasing a car (answering questions via chat), replicating a launch event or dealer open house online. And at any time, an individual customer can request a private video call with a Škoda product host who will guide them around a vehicle in a studio in real time, even helping with configuration and booking a test drive at a local dealer. This program proved effective: in the first 8 weeks of launching the Live Tour in one country, Škoda logged over 800 live video calls averaging 12 minutes each, generating 250+ qualified leads. These immersive initiatives show that when digital shoppers can experience the car virtually – seeing it from every angle or having a friendly expert “by their side” on screen – it dramatically increases their engagement.

-

Proactive, Data-Driven After-Sales: On the retention side, leading brands are leveraging data to anticipate customer needs. Connected vehicle data now lets companies like Tesla or Ford alert owners about service requirements proactively (even to the point of shipping replacement parts or scheduling mobile service before a failure happens). Some OEMs send personalized maintenance videos to owners explaining what service their car needs and why – adding transparency and education to the experience. These efforts are aimed at increasing trust and convenience in the ownership phase. Additionally, many manufacturers have rolled out loyalty apps or programs – for example, FordPass and GM’s My Chevrolet app – that consolidate rewards, remote services, and support in one place. The goal is to keep owners within the brand’s ecosystem through useful, user-friendly digital tools. Notably, brands that provide a smooth omnichannel service experience (e.g. easy online scheduling, visible service history, quick follow-ups) have seen upticks in customer satisfaction scores. This directly correlates with higher repurchase intent, mitigating that dreaded post-purchase defection rate.

-

Embracing Omnichannel Sales Models: Lessons from SEAT CUPRA Poland: The shift toward omnichannel retail in automotive isn’t a theory—it’s happening now. A clear example is SEAT CUPRA Poland, where real-time engagement technology from Onlive.site is enabling customers to move fluidly between online discovery and dealership interaction. Shoppers can initiate a live video consultation, configure a vehicle, request a callback, or schedule a test drive—without ever leaving the website. This isn’t a digital showroom or a dealer website; it’s both, combined. Within months of implementation, CUPRA Poland achieved 90% reduction in cost per lead (CPL) & 5.5x increase in qualified leads.

But what does this signal more broadly?

It reflects a market-wide realization: today’s car buyers don’t want to be boxed into a single sales channel. Some will still prefer the classic, in-person experience. Others—especially digital-first buyers—may want to explore, decide, and even purchase entirely online. And many fall somewhere in between, starting their journey on a website, but choosing to complete it with an advisor or at the dealership.

This trend doesn’t mean dealerships are disappearing overnight—most markets still rely on dealer partners for test drives, deliveries, and service. But it does confirm that manufacturers and dealer networks alike are investing in flexibility: giving customers multiple ways to engage, progress, and purchase.

Omnichannel retail isn’t just about meeting buyers where they are, it’s about letting them move at their own pace and comfort level. Whether someone wants to explore a CUPRA with a product expert via video, book a test drive for the weekend, or simply ask a question mid-configurator, the experience is there—connected, contextual, and customer-driven.

As digital expectations grow, automakers that blend physical and digital touchpoints aren’t just reacting to change—they’re shaping the new baseline. Omnichannel innovation, as shown by CUPRA’s approach, is becoming a core pillar of sales strategy—not just a feature.

Real-time integration and channel choice are the new standard. Brands who offer them make it easy for customers to say yes, however and wherever they decide to buy.

Conclusion: Evolving from Automotive to Experience

All the data points to a clear conclusion: the automotive industry in 2025 must evolve from being product-centric to experience-centric. In an era where consumers compare buying a car to the convenience of hailing a rideshare or ordering an iPhone, auto brands have to close the gap quickly. The good news is that the path is now illuminated by data and early wins. We know personalization drives purchase decisions. We know instant response and digital convenience yield higher conversions and lower cost. And we know that neglecting the customer after the sale is simply handing future business to your competitors.

The state of Automotive CX in 2025 is one of both warning and opportunity.

The warning: status quo tactics – static websites, slow follow-ups, siloed channels – are already resulting in lost sales and disloyal customers.

The opportunity: brands that invest in customer-centric innovation can differentiate themselves markedly in a market where many have been slow to change.

The leaders are leveraging technology (AI, analytics, digital platforms) and organizational focus (strategy, training, cross-department collaboration) to deliver the kind of seamless, personalized, and responsive experiences that modern consumers expect. They’re effectively writing the playbook for automotive CX 2.0.

For every automaker and dealership, the imperative now is to ask: How does our customer experience stack up, and where do we need to improve, fast? The data says that the basics – quick test drive scheduling, helpful online engagements, consistent omnichannel support – make a world of difference. The brands that get those basics right are not only converting more leads today, they’re building the loyal owner base that will sustain them in the years ahead. In the race to win over the 2025 automotive consumer, the finish line isn’t just who sells the most cars – it’s who leaves the customer happiest. And that, increasingly, is determined by CX.

What does omnichannel car buying mean in 2025, and how are automotive brands adapting?

Omnichannel car buying in 2025 means offering customers multiple, flexible paths to research, configure, and purchase a vehicle—whether fully online, entirely in-person, or a mix of both. Brands like CUPRA are adapting by integrating real-time engagement tools (like Onlive.site’s video widget) directly into their websites, allowing buyers to talk to product experts, book test drives, or request callbacks without leaving the digital journey. This seamless connection between online exploration and dealer execution is becoming the new standard in automotive CX

re car dealerships going away with the rise of online car buying?

No, dealerships are not disappearing—but their role is evolving. While more buyers are starting and even completing their car purchase journey online, most still rely on dealer partners for test drives, in-person consultations, deliveries, and service. Leading brands like SEAT CUPRA Poland are future-proofing their sales models by combining digital convenience with dealer support, creating hybrid journeys that adapt to individual buyer preferences.

How does Onlive.site help automotive brands deliver omnichannel experiences?

Onlive.site helps automotive brands like CUPRA deliver true omnichannel experiences by embedding real-time video consultations, test-drive booking, and expert support directly into their websites. This allows customers to switch between online and offline interactions seamlessly—starting with a live chat or video call and ending with a confirmed dealership appointment. The result is a unified, data-driven customer journey that reduces cost per lead, increases engagement, and boosts conversion rates.

-1.png)